When selecting whether or not to rollover a retirement account, you ought to cautiously think about your individual problem and Tastes. Details supplied by Beagle is only for typical functions and is not intended to exchange any individualized suggestions for you to observe a specific recommendation.

The uses of these kinds of entities are varied. A Belief fashioned previous to marriage is considered outdoors your marital estate. The assets are immune to divorce and come up with a prenuptial agreement pointless. A Self-Settled Have confidence in may also be the foundation of an estate program both now or in a while.

You need to take into consideration each of the factors that should be evaluated inside a rollover determination like investment selections, fees, expenses, penalties and account protections from authorized and creditor challenges, and generate a comparison to your latest retirement account. You must talk to with the own monetary and tax advisor prior to making a rollover final decision.

Neither looking through This web site, nor Talking to our client services staff in almost any way obviates the competent Qualified enable we urge you to seek. it truly is of utmost importance you retain knowledgeable prior to embarking on any action discussed herein.

We demonstrate the variances between two of the most common forms of everyday living insurance plan to help you decide what could possibly be best for your needs.

You have to preserve private legal responsibility insurance for your lesser of a million pounds or the worth of Believe in transfers.

Every single condition's Believe in regulations are different. There are Self-directed retirement account firms states which never make it possible for Self-Settled anti-creditor Trusts or do not need as helpful of conditions. There exists tiny priority for a way courts shall determine in the event the rules of states conflict.

You will find there's 10-12 months seem-back again period of time for transfers to Asset Protection Trusts once you go bankrupt. Should you be located to become deliberately defrauding an investor, then the assets within the Have confidence in will not be protected against individual bankruptcy proceedings for ten many years.

As may be witnessed above, the Wyoming Asset Protection Have faith in guards Virtually any type of house; even so, when conducting the transfer, it's essential to also affirm as follows:

Have confidence in rules are decided at the point out stage, and Wyoming is one of the couple states that allow for persons to sort Asset Protection Trusts for on their own. The Have confidence in offers asset protection and privacy from creditors and individual bankruptcy.

All investments have possibility, and no investment technique can warranty a profit or protect from lack of cash.

Beagle can show you the entire concealed costs which can be robbing your retirement of 1000s of dollars.

At Beagle, we ended up Uninterested in how tough it was to monitor our outdated 401(k) accounts. We under no circumstances knew in which they all had been, whenever they had been making income or what expenses we ended up having to pay. That’s why we produced the easiest way to search out your whole 401(k)s.

The combined outcomes of those approaches look at more info could reduced your tax liabilities, together with payroll taxes, by around 70% or more.

An entrepreneur at heart, Andrew Pierce Established Wyoming LLC Attorney right after going through his have company formation worries. Which has the original source a history in company structuring, he's committed to making lawful steering obtainable and reasonably priced so Other individuals can get started with self-assurance.

Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Mason Reese Then & Now!

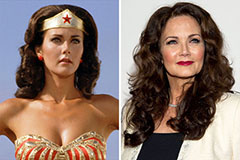

Mason Reese Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!